I. Share Buyback Tax Hits Infosys, other stocks (Source - mint)

- Union Finance Minister Nirmala Sitharaman on Friday imposed a tax on buyback of shares.

- New law is expected to result in a taxation of at least 20% on companies payout to shareholders

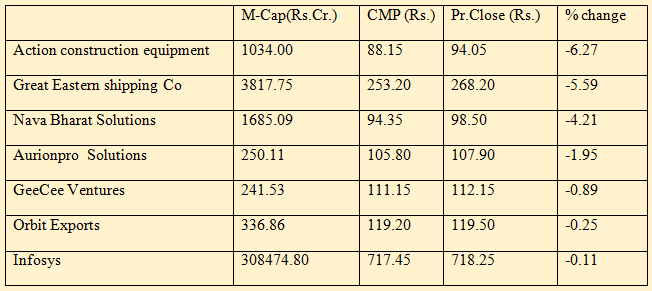

The new tax on share buybacks has hit Infosys and seven other companies straightaway, as repurchase offers of these companies are currently open.

Union Finance Minister Nirmala Sitharaman has imposed a tax on buyback of shares. As a result, eight listed companies, whose buyback offers are open, would now need to pay tax at the rate of 20 per cent plus surcharge and cess on the amount of consideration paid less the issue price of such shares.

The companies that have taken the unexpected hit included IT behemoth Infosys, Orbit Exports, Aurion Pro Solutions, Action Construction Equipments, Nava Bharat Ventures, GE Shipping and Geecee Ventures. Over the past three years, domestic IT companies have stepped up payout ratios and used a mix of dividend and share buybacks to return profits to shareholders.

For instance, out of the total cash returned to shareholders by TCS in last two years, 60 per cent was done through buyback and 40 per cent through dividend. Wipro has largely used the buyback route after an increase in the dividend distribution tax. Nearly 90 per cent of the company’s payout in last two years was through share buybacks.

The amendment leads to taxation of at least 20 per cent on payout to shareholders, which is a disincentive. This tax is effectively an alternative form of income-tax.

In her maiden Budget speech, Finance Minister said, in order to discourage the practice of avoiding dividend distribution tax (DDT) through buyback of shares by listed companies, it is proposed to provide that listed companies shall also be liable to pay additional tax at 20 per cent in case of buy back of share, as is the case currently for unlisted companies.

The statement implied buyback tax has now been extended to listed companies as well. Correspondingly, investors will not have to pay any tax on capital gains on buyback as this is now exempted.

The proposed provisions came into effect in respect of buyback undertaken from July 5, 2019.

II. High promoter holding companies likely to underperform (Source - The Economic Times)

- Proposed move to increase minimum public shareholding would impact 1,400 companies.

- Many of these stocks have premium valuations because of restricted free float.

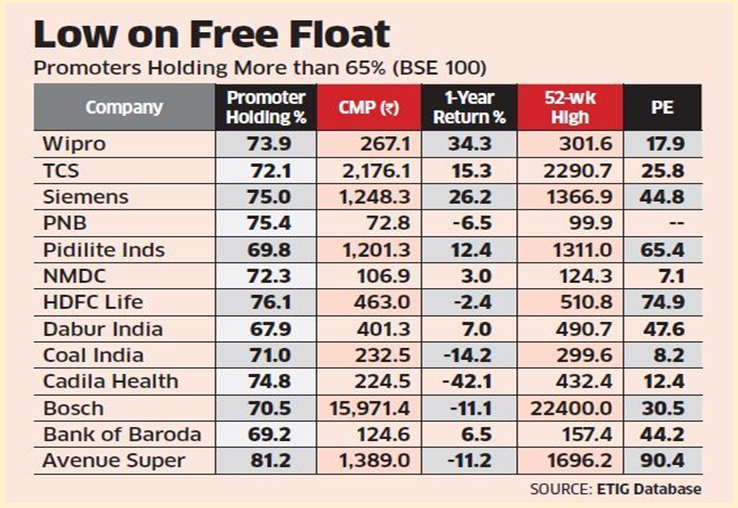

Companies with promoter holdings beyond 65% of the outstanding equity base are likely to underperform in the next two years, as excess supply of stock may not always be met with sufficient demand to ensure price stability.

The proposed federal move to increase minimum public shareholding from 25 to 35% would impact about 1,400 listed companies, including TCS, Wipro, HDFC Life, Avenue Supermart, Dabur, Bandhan Bankand Pidilite Industries among others. These stocks are also unlikely to cross their yearly highs in the near term.

The move to increase public holding will lead to valuation corrections as many of the stocks are quoting at premium valuations because of the restricted free float.

The sell off will be an overhang on stock prices in these companies until they end up selling stakes to investors. Quite possible, the valuations will come down under the given situation….the longer it takes, the more painful it would be.

Most of the offers for sale done recently to meet minimum public holding norms are with a discount of 5-10% to the market price. Of the last 15 OFS proposals, 11had offered discounts between 3 and 14%. The SBI Life Insurance OFS was priced at Rs 650 per share when the prevailing stock price was at Rs 710. Similarly, L&T Technology Services OFS was at a discount of 6% to the market price.

Kotak Mahindra Bank shares underperformed in the past one year due to uncertainty about dilution in the the promoter’s stake. The stock gained just 9.5%, while ICICI Bank and Axis Bank climbed 60% and 54%, respectively, in this period. HDFC Bank gained 16% during this period.

If increased public shareholding norms are implemented, the supply of paper in the market will increase and investors would rather wait to buy at a discounted price.

At present, of the BSE 500 companies, 100 have promoter stakes above 65%. There are 40 PSUs with public holding lower than 35%. TCS alone would be required to dilute worth Rs 60,000 crore to reduce its stake from 72.05% to the proposed 65%.

III. Buyback tax: Will it hurt minority shareholders? (Source - Business Line)

KPR Mill is the first company to withdraw its buyback plan after the Union Budget imposed a tax on buyback of shares of listed companies, a tax that was until now imposed only on unlisted entities.

KPR Mill had proposed (on April 18) and approved (on April 30) buyback of 37.5 lakh shares, representing 5.17 per cent of the total equity capital at Rs. 702 a share for a total consideration of Rs. 263.31 crore.

However, in a notice to the stock exchanges, KPR Mill said, we have today (on Thursday) filed with SEBI our communication conveying that the increase in the amount of buyback obligation due to the tax proposal in the Finance Bill 2019 was neither contemplated nor prevailing at the time of the consideration and the approvals of the board and shareholders.

As the company is not permitted to meet the buyback obligations beyond the amount approved by the board of directors and shareholders and the same can be effected only with borrowed funds, which is prohibited by law, KPR Mill was forced to withdraw its buyback plan, it further clarified.

Budget burden:

In a move to crack down on companies avoiding dividend distribution tax and dividend taxation in the hands of their large shareholders, in the Budget last week, Finance Minister Nirmala Sitharaman proposed an additional tax of 20 per cent for listed companies proposing buyback of shares.

The buyback route was beneficial to shareholders till now, due to the non applicability of additional dividend tax under Section 115 BBDA in the hands of the shareholders.

With the proposal, the advantage of buyback over dividend distribution is largely negated. Assuming a company having cash surplus of Rs. 100 for distribution to shareholders, earlier the tax incidence would be just Rs. 10 (10 per cent long term capital gains tax, for holding shares for more than a year). Under the new proposal, assuming the company has the same surplus, investors would get only Rs. 79, after a 20 per cent tax, including surcharge and cess paid by the company.

On the other hand, the effect of distribution tax on dividend, computed on grossed up basis, will work out to about 20 per cent on small shareholders (including surcharge and cess). For promoter shareholders though, the tax incidence is higher because of the additional 10 per cent tax on dividend receipts of over Rs. 10 lakh.

Needs clarity:

However, the new proposal does not account for capital loss, i.e., if the acquisition price is higher than the buyback price. It needs clarity on whether long or short term capital loss on buyback in shareholder’s hands would be available for set off in subsequent years.

The proposed tax might see many companies following KPR Mill’s example, which could negatively impact minority shareholders, as buybacks not only help shareholders receive surplus cash but also give stability to the company’s share price. Buybacks also help boost earnings per share of the company and thus, shareholder value.

What shape the distribution of surplus cash by companies will take from now, needs watching.

Hope you enjoyed reading this publication

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.