I. Why you should not choose mutual fund schemes only on the basis of cost (Source - The Economic Times)

Wealth managers say investors should not buy a mutual fund strictly on the basis of lower costs.

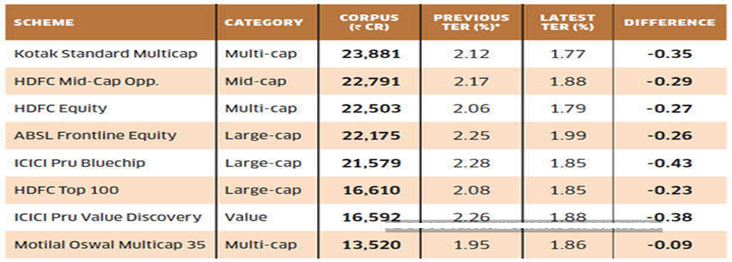

Revised cost slabs for mutual funds have come into effect from 1 April. Accordingly, several equity funds with large asset bases have sharply cut their expense ratios. How much will you benefit from this moderations in costs? The market watchdog had proposed revised cost slabs and rates for mutual funds last year. The cost structure essentially puts in place incremental cuts in the base expense ratio at different intervals of growth in a fund’s corpus. Under the revised system, larger funds have had to cut costs sharply. For the top 25 equity schemes by asset base, the total expense ratio has moderated by 20 bps on an average, compared to last month.For several schemes, the costs declined by more than 30 bps. For instance, the TER for ICICI Prudential Bluechip reduced sharply by 43 bps from 2.28% at the end of March 2019 to 1.85% on 12 April. The TER for the largest equity scheme Kotak Standard Multi Cap fell from 2.12% to 1.77% during this period.

A scheme’s TER is calculated daily and is adjusted from its value to arrive at the daily net asset value (NAV). Thus, a larger TER eats more into the fund’s return. According to experts, the reduction in costs of larger funds will lead to gains for investors in the long run. The cost reduction is along expected lines and will add back to the net return of these funds over the long run.On an investment of Rs 2 lakh, 30 bps lower costs means that the investor saves around Rs 600 annually, which will get added to his overall returns. At 14% annualised return, this Rs 2 lakh yields Rs 7.41 lakh over 10 years. If the cost is 30 bps lower, the same fund will fetch a corpus of Rs 7.61 lakh over the same period.This gap will be bigger for larger investments. Besides, lower the expense ratio, higher is the chance of the scheme beating and delivering healthy returns over its benchmark index. Funds that were earlier struggling to beat the total return index can now do so. Large cap funds in particular stand to benefit from the lower cost.

At the same time, the costs for smaller funds have not budged much. In fact, costs for several of them have inched up under the revised structure. Does this mean investors should realign the fund portfolio to take advantage of lower costs?

Some schemes have seen sharp cut in costs

Reduction in costs will lead to some gains for investors in the long run.

TER is Total Expense Ratio. *As on 31 March.

Wealth managers say investors should not buy a fund strictly on the basis of lower costs. Expense is just one of many parameters for choosing a fund. There is no conclusive evidence to show that funds with lower costs tend to outperform others. Nor is there any evidence to suggest that schemes with larger asset base tend to underperform smaller sized funds or vice versa. Most of the larger funds have amassed the size on the back of outperformance over the years.

However, a few larger funds have also witnessed a dip in their return profile in recent years. Investing in these larger funds purely for lower costs ignoring a deteriorating return profile will prove costly. Besides, the cost reduction is too modest for most schemes.

Investors in equity funds will not materially benefit from a 20-25 bps reduction in cost. However, this will make a big difference in returns from debt funds.

Several smaller sized funds have built a strong track record in recent years. Many of them are from categories such as mid-cap, value or focused that have not yet amassed a high asset base. Several quality mid-cap funds, for instance, boast a healthy return profile but have a higher expense ratio. For investors whose risk profile permits the aggressive stance, the higher return will adequately compensate for the higher expense ratio. But ignoring these schemes purely owing to higher costs may lead to investors missing out on potentially high returns.

Among equity funds, low costs are more relevant for large-cap funds, which now compete directly with ultra-low cost ETFs and index funds. With large-cap funds finding it increasingly difficult to deliver alpha, these have no option but to reduce costs. Large cap funds will now get some leeway to show outperformance over the benchmark index.

For mid-cap and multi-cap funds, the cost is not as relevant, insist experts. Investors should be more concerned about consistency in the fund’s return profile. In fact, mid-cap funds with very large asset base tend to face issues absorbing inflows and maintaining portfolio liquidity. Smaller sized mid-cap funds can be more nimble than their larger peers.

Hope you enjoyed reading this edition.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.