I. How equity, debt and gold investments did in 2019 (Source - The Economic Times)

- Weakness in economy caught most companies off guard, it is feared that expected earnings recovery may get postponed.

- However, the stock market may still remain firm and hopeful.

- Some experts believe that the economic situation will improve in 2020.

The political landscape became very stable after the BJP won a clear mandate in the 2019 Parliamentary elections. However, the same cannot be said about the economic and financial markets. The crisis in the non banking financial companies (NBFCs) triggered by the collapse of IL&FS in September 2018 spread to other sectors in 2019. The real estate and auto sectors were badly hit due to the reduction in NBFC funding. The demand for consumer goods also took a beating.

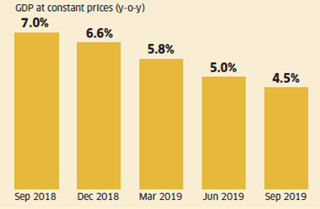

The weakness showed up in macro economic data, with the GDP growth rate falling to 5% in the first quarter of 2019-20 (April-June) and then dropping to a six year low of 4.5% in the following quarter (July-September). If you are a stock investor, it is not time to go bottom fishing yet. The initial numbers coming out for the third quarter (October-December) are also looking weak and most experts feel that growth could recede further to 4%. The global economic turmoil has aggravated India’s problems, even as the trade war between the US and China adds another layer of uncertainly.

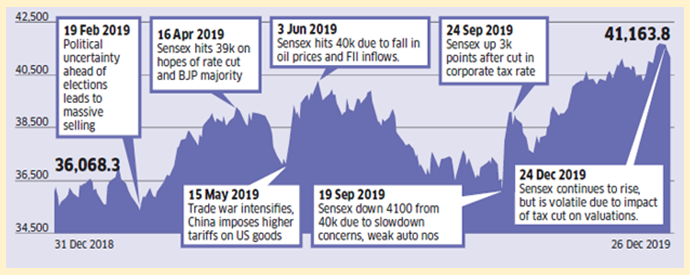

Stock markets remained volatile in 2019

The Sensex continued its upward trajectory and hit an all-time high of 41,809

The redeeming feature of 2019 was the series of measures taken by the government and the RBI to fight the economic slowdown. The most significant measure was the lowering of the corporate tax rate from 30% to 22% for existing companies, and to 15% from 25% for new manufacturing companies. The effective tax rate for existing companies is now down to 25.17% from 35%. The tax bonanza for the corporate sector electrified the markets. The Sensex rose 1,799 points (or 5%) on 20 September, its biggest one day rally in 10 Years.

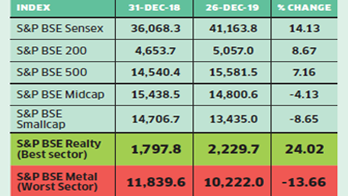

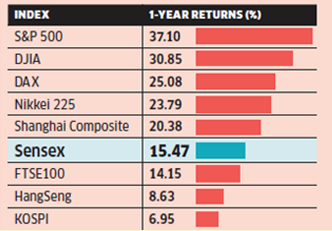

How markets fared in 2019 (Data upto 26.12.2019)

Only handful of stocks rose in 2019

Broader markets did not do well during the year.

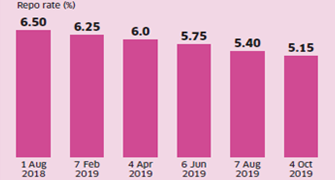

The RBI did its bit by cutting interest rates. The central bank cut the repo rates by a significant 135 basis points in 2019 (100 basis points make up 1 percentage point), though this reduction has not been fully transmitted and lending rates continue to remain high. Banks say they can not lower the lending rates because their cost of borrowing continues to be high, which in turn is due to the competition from the high yields of government managed small saving schemes.

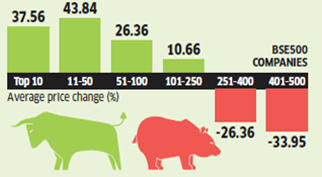

FII returned to markets while mutual funds slowed down

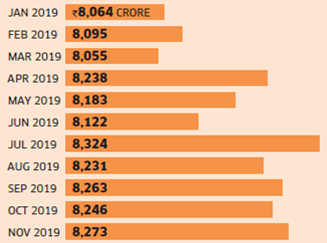

Net inflows in equities in Rs crore during 2019 (Data upto 26.12.2019)

Even so, the banking system saw a major structural change with the introduction of external benchmarks for loans in October. Though this move may not bring down lending rates, it will certainly bring more transparency in the way banks compute the interest rate applicable to a loan. Now every borrower will know what his loan rate will be and why it is moving up or down. Another advantage of the new regime is the faster reset clause. RBI has asked banks to do it within three months. Repo linked loans from SBI will be reset on a monthly basis. Any changes in the rate will be transmitted on the first day of the next month.

Global markets did better in 2019 (Data upto 26.12.2019)

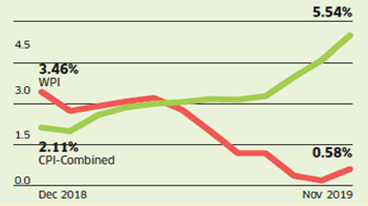

Wholesale inflation was down but consumer inflation shot up (Data upto Nov 2019)

Hoping for recovery

Some experts believe that the economic situation will improve in 2020. The restructuring and consolidation are yielding results, as visible from the improvement in the bank balance sheet and reduction in system wide NPAs. Economic growth in 2020 will be better than what it was in 2019. We are close to the bottom of the cycle, though the expected recovery will be slow due to several reasons, such as the low confidence level among consumers and industries. Also, the problem in some sectors such as residential real estate will take more time to recover.

GDP growth rate hit a 6-year low (Data upto Sep 2019)

SIP inflows were flat during 2019 (Data upto Nov 2019)

The weakness in the domestic economy caught most companies off guard and it is feared that the expected earnings recovery may get postponed. However, the stock market may still remain firm based on hope. Since the earnings recovery may get postponed, the stock market rally in 2020 will be based on hope of better earnings in 2021. In fact, the chase for quality was the defining theme in 2019, which resulted in the narrow stock market rally led by a handful of stocks. The 10 stocks which saw the biggest increase in market capitalisation rose by an average 37.6% during 2019, but the bottom 100 stocks fell 34%. This is also reflected in the higher percentage gains registered by large cap indices such as Sensex and nifty compared to the mid cap and small cap indices.

RBI cut rates aggressively in 2019 (Data upto 4th Oct 2019)

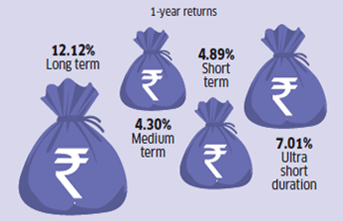

Long-term debt funds did well (Data upto Dec 2019)

Bond market in 2019

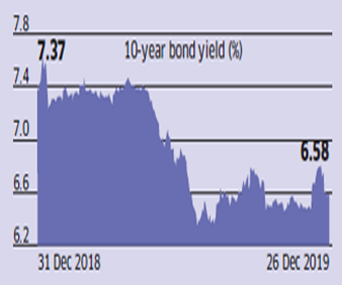

Bond yields fell sharply during 2019, thanks to the aggressive rate cuts by the RBI. Debt mutual funds, especially those which had lined their portfolios with long term bonds, churned out spectacular returns in the first half of the year. Some long term bond funds rose almost 20%. However, towards the second half of the year, the bond yields started moving up again, leading to muted returns from debt funds. Even so, the long term bond category ended the year with 12.12% returns (see graphic), while other debt fund categories fared poorly.

The govt bond yield fell sharply (Data upto 26.12.2019)

On the other hand, fixed deposit and recurring deposit rates came down due to the cut in interest rates. Interest rates on fixed deposits from leading banks such as SBI and HDFC Bank are at very low levels, though cooperative banks and companies are offering higher rates. Investors need to be careful about these entities and stay away. Since mutual funds may also buy into their papers of these low quality companies to increase returns, investors also must go through scheme portfolios and avoid debt schemes that take too much risk.

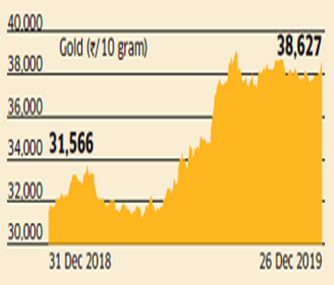

Gold shot up 22% during the year (Data upto 26.12.2019)

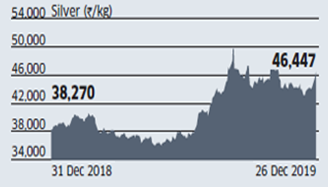

Silver also rose 21% during 2019 (Data upto 26.12.2019)

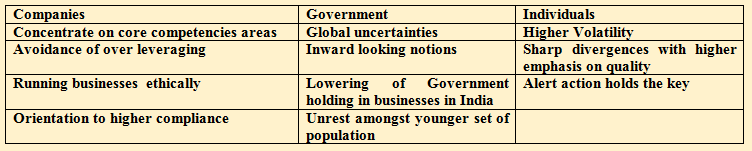

Conclusion

Based on the above, the various constituents should embrace upon the following factors:

Wishing you all a pleasant and a prosperous year 2020.

Hope you enjoyed reading this edition.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.