1. Inflation reverses course in July, quickens to 2.36% (Source-Mint) Trend reversal lowers RBI ratecut chances; pace of decline in vegetable prices slows.

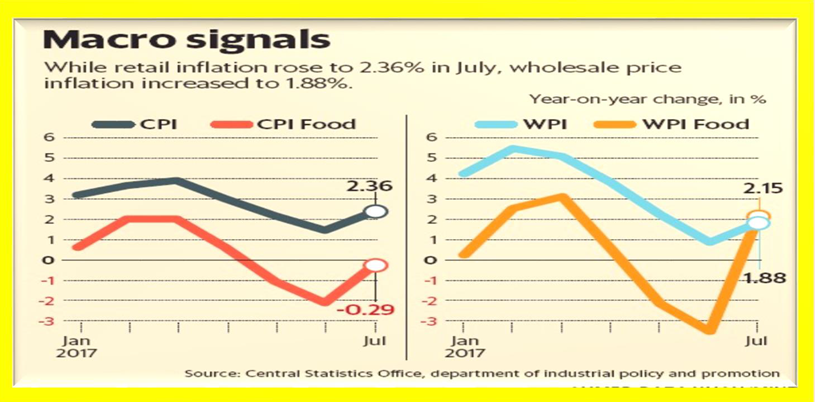

India’s retail price inflation quickened to 2.36% in July, reversing its downward trend, as prices of some vegetables shot up, reducing the probability of any near-term interest rate cut by the central bank.

Consumer price index-based (CPI-based) inflation was at 1.46% a month ago.

The pace of decline in vegetable prices slowed to 3.57% in July from a 16.53% contraction in the previous month, data released by the Central Statistics Office.

Data separately released by the department of industrial policy and promotion showed India’s wholesale price index-based (WPI-based) inflation quickened to 1.88% in July, led by increases in food and mineral prices, compared with a 0.90% gain a month ago.

Inflation for housing (4.98%) and fuel and light (4.86%) segments also accelerated in July, reflecting the government’s decision to implement the recommendations of the 7th Pay Commission for central government employees regarding allowances and hike in fuel prices. The government’s recent decision to hike cooking gas prices by Rs4 a month till the subsidy is eliminated may further fuel retail inflation.

Higher prices on account of implementation of the goods and services tax, which came into effect from 1 July, also contributed to the reversal in inflationary trends, said Aditi Nayar, principal economist at ICRA Ratings.

“As the favourable base effect unwinds, vegetable prices record a seasonal hardening and the impact of HRA (house rent allowance, increased in the 7th Pay Commission) pushes up housing inflation further, we expect CPI inflation to ramp up over the next few months, and cross 4% by October 2017. Based on this anticipated trajectory, and the recent commentary by the monetary policy committee, we see a low likelihood of further rate cuts in 2017-18,” she cautioned. The Reserve Bank of India (RBI), which cut its key policy rate by 0.25 percentage points earlier this month, retained its neutral policy stance, citing uncertainty on the future trajectory of inflation because of several uncertainties. “If states choose to implement salary and allowance increases similar to the centre in the current financial year, headline inflation could rise by an additional estimated 100 basis points above the baseline over 18-24 months. Also, high frequency indicators suggest that price pressures are building up in vegetables and animal proteins in the near months,” it added. The second volume of the Economic Survey 2016-17 presented in Parliament took a contrarian view and maintained that India is undergoing a structural shift toward low inflation, mostly due to changing dynamics in the oil market, which has capped upside risks.

“More recently such shifts seem to have been missed, for example, in the last 14 quarters, inflation has been overestimated by more than 100 bps (basis points) in six quarters with an average error of 180 bps,” it said. One basis point is one-hundredth of a percentage point.

The Survey implicitly blamed RBI for the slowdown in economic growth due to “tighter than assumed” monetary policy.

While the volume of monsoon rainfall is near-normal, its uneven geographic spread poses a concern to future inflationary trends. For instance, the southern peninsula has seen a substantial 16% shortfall in rainfall. The decline in sowing of various oilseeds (-9.9%), pulses (-1.6%) and coarse cereals (-1.5%) may also affect their prices and exert some upward pressure on inflation in the coming months.Devendra Kumar Pant, chief economist at India Ratings and Research, said that monsoon-induced inflation shocks from fruits and vegetables are likely to reduce, but the unfavourable base effect from August may lead to further acceleration in retail inflation.

“Lack of consumer demand and pricing power of producers makes conduct of monetary policy very difficult,” he added.

2. IPOs lined up over next 2-3 months will absorb a lot of domestic liquidity(Source-Mint)

Valuations were not supported by earnings. Liquidity can only support till a point,” says Krishna Kumar Karwa, managing director of Emkay Global Financial Services. In an interview, he points to how the markets corrected on geopolitical tensions around North Korea, saying that shows that earnings are still not good enough. Karwa says the next 2-3 months will see many IPOs hitting the market, which will soak up domestic liquidity. But a good monsoon will have a positive impact, he adds.

Earnings have not obliged. How long can you keep the faith? To be fair, liquidity has obliged, much more than anyone thought. So do you still keep the faith, buying at every dip?

This is a time to be slightly circumspect because valuations are not getting supported by earnings and liquidity can only drive you to a point. Earlier issue on the North Korea- US front and all of us believed that North Korea is not going to fire any missiles at the US.

But still there was a decent correction locally as well as globally, which clearly shows that earnings are not supportive or valuations are at level where with any small negative news, markets can correct.

So, yes, all of us are hopeful that earnings will recover in maybe the second half of the year and next year, etc. and in this liquidity – driven rally, so far, people have bought on dips and it has worked very well for them. Let us hope that it continues, but in the next 2-3 months, there is a whole spate of initial public offerings (IPO) which are lined up. That will absorb a lot of the domestic liquidity per se. So looking at all these factors, investors should continue to have faith, but return expectations will have to be moderated from an immediate perspective. Maybe it is more back ended in terms of the earning opportunity. But monsoons have made a good comeback so that could be a good trigger in the next month or so if monsoons do well. Also, the third quarter is going to be a quarter where you have a benefit of a low base because of demonetization last year. So markets will be benign and hopeful till the third quarter. If we do not see year on year (Y-o-Y) growth in the third quarter then there can be a challenge for the market. That is my take.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.