I. Cash-strapped developers offer barter deals to construction firms (Source - mint)

- Builders offer unfinished apartments instead of cash to contractors as liquidity crunch hurts both parties.

- Midto small size construction firms are increasingly accepting such cashless payments either to speed up a project or prevent it from stalling.

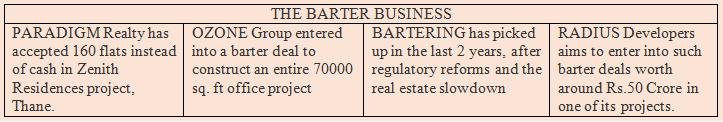

The barter is back in fashion in real estate as cash strapped developers offer unfinished apartments instead of cash payment to their construction contractors, as a prolonged sales and liquidity crunch hurts both parties. Mid to small size construction contractors are increasingly accepting such ‘cashless’ payments either to speed up a project or prevent it from stalling, according to several industry executives. The barter system allows a developer to complete the project without paying the construction company and helps the latter secure business in an otherwise weak market.

In one instance, Paradigm Realty, a construction firm, has accepted payments in the form of 160 apartments out of the total 300 in the Zenith Residences project at Thane near Mumbai. More such deals are reported under negotiation. Certain stocks are taken at a predetermined rate. A lot of contractors have started opting for this route as they have not got their payment or for fear of non payment. Such deals are small in nature and worth Rs. 30-40 crore, but it helps speed up the construction or take it to a level where sales would then take care of the project.

Earlier this month, a developer entered into a barter agreement with a construction firm to construct an entire 70,000 sq. ft commercial office project in exchange for some space in the building at a discounted rate. It has also done barter exchange worth around Rs. 10 crore with contractors in Ozone Greens, its residential project in Chennai.

Given that finances are rare in today’s market, such barter deals will happen. Some developers have tried it on a pilot basis and are exploring the feasibility of doing more such deals across most of their projects.Such bartering has picked up in the last two years, after various regulatory reforms and the slowdown in the realty sector.

Bartering has emerged as a win method for both developers and contractors given the slowdown in the industry, according to real estate experts.

Developers have found a way out through bartering to survive this liquidity crisis. This works for both the parties, especially small time construction firms as they also face a tough time finding contracts. They have to keep themselves busy to survive in the industry. There are credit issues in the market. So barter works. If we have to continue construction, we have to innovate. There is a clear sluggishness in the construction sector as well. They have to also beat that slowdown.

II. The Jaypee Jigsaw; filling the final pieces (source - mint)

- The SC rulings on Amrapali and Unitech cases have given fresh hope to thousands of Jaypee homebuyers.

- Rera, an entity formed after Jaypee was admitted as a bankruptcy case, offers no hope to the Jaypee’s stranded buyers, who continue to fight their battle in various courts

It will be over someday soon, but, hopefully, not before it has taught a lesson to everyone involved the government, the judiciary, homebuyers, and the promoters of Jaypee Infratech Ltd (JIL), an arm of the Manoj Gaurrun Jaiprakash Associates Ltd (JAL). It is a classic case of greed versus fear an ambitious promoter unable to manage risks and a government content with making rules without attempting to enforce them.

The playground was Jaypee’s 6,175 acres of land spread over five locations in Uttar Pradesh, namely Noida, Mirzapur, Jaganpur, Agra and Tappal, with most of it lying in Noida. The land came to JAL in 2007 as part of an Uttar Pradesh government contract to build a 165 kilometres long expressway between Noida and Agra. Things turned sour in 2012 when the real estate market imploded spectacularly, particularly in the boomtowns that ring fence the National Capital Region. Housing projects ground to a halt. Customer advances got stuck in companies on the verge of insolvency, such as Jaypee. Caught in the vortex are now some 20,000 buyers waiting for their dream home in one of the 12 projects that the Jaypee group planned to construct at its so called Wish Town township.

For some, the wait is now well over five years, even as at least 50 cases do the rounds in the Supreme Court, the National Company Law Appellate Tribunal (NCLAT), the National Company Law Tribunal (NCLT), and various consumer courts. The latest Supreme Court judgment in the Amrapali matter, another case of homebuyers versus an errant builder has rekindled hope among Jaypee customers of an early resolution.

The apex court last week cancelled the licence of Amrapali Group and asked NBCC (India) Ltd to take over all its ongoing, unfinished housing projects. The Supreme Court has unequivocally put the homebuyers interest at the top of the ladder and we hope other stakeholders and quasi-judiciary bodies take a message from this ruling. Homebuyers are looking at NBCC and banks with a lot of hope, that our agony will end soon.

On Monday, the Supreme Court ordered NBCC to take over as a consultant and find a way to complete a slew of unfinished housing projects that belong to Unitech Group, whose promoters are currently in jail for defrauding homebuyers. For the thousands of homebuyers who sunk their hopes on barren patches of land in Noida, the wheels of the system finally seem to be creaking forward.

The Jaypee saga, in particular, will leave ripples across the real estate industry for years to come. It was perhaps the first insolvency case against a real estate developer in India. The slew of court battles that ensued have already resulted in two marquee changes: a homebuyer is on par with a bank or lender in an insolvency court, and there is now the new threat of a public sector entity, like NBCC, taking over incomplete housing projects.

The era of zero finance from the builder, where customers paid money upfront, is over. Significant changes in law and regulations are inevitable going forward since the Supreme Court has clearly set a precedent by siding with the weaker party, the consumer.But even as those fairer terms of engagement, between homeowner and developer, await to be written, for those trapped in the middle, the immediate concern is who will build the houses and when will it be built? One critical difference between the Amrapali case and Jaypee case is that there are still assets (like the Yamuna Expressway) lying with Jaypee, all of which can be monetized. That has resulted in homeowners and banks fighting pitched battles in the halls of bankruptcy tribunals. Banks would, after all, like to liquidate the assets and recover as much money as possible, while homebuyers would want someone to build them a home. In August, the Jaypee liquidation drama would cross 350 days since it began last year. And all eyes, unsurprisingly, are on the Supreme Court. While it is one particular case involving a single developer, the outcome may have wide ranging fallout in a country where an estimated 500,000 houses remain unfinished for well over six years in the top seven cities alone.

Boom and bust

It was the heydays of the first decade of this century, with all asset classes booming equities, gold, commodities, and, of course, real estate. Gaur then, coming into his own after his father and founder of the Jaypee group had ceded day to day operations, was a businessman on overdrive. The group went into major expansion in power and cement capacities between 2005 and 2012. At one point, JAL was the third largest cement manufacturer in the country with an annual capacity of 33 million tonnes.

Rumoured to have close ties to the then Uttar Pradesh chief minister and Bahujan Samaj Party chief Mayawati, every tender that Gaur touched turned into gold. That fetched him the expressway order that would eventually prove to be his nemesis. JIL was JAL’s special purpose vehicle (SPV) that would develop, operate and maintain the expressway that arguably is one of the best pieces of infrastructure created in the country. A Formula 1 track on the expressway, besides a hospital, a school and a college came up alongside.

Over the next four to five years, the group would go on to announce as many as 27 real estate projects split between JAL and JIL comprising flats and villas of various sizes to cater to classes ranging from the middle income groups to the super rich. The group would run full page advertisements in leading newspapers, offering dream homes at five locations in Uttar Pradesh. Many non-residents, either returning to India or those remitting money, bought into the promise.

And then came the collapse of the real estate sector, somewhere around 2012-13. The Noida region was the worst hit. Banks curtailed lending and consumers withdrew. The industry went into a tailspin as the Narendra Modi government went after black money. To make matters worse, an adverse ruling in 2015 by the National Green Tribunal, banning all construction within a kilometre of the Okhla Bird Sanctuary, an area not far from Noida, further affected sentiment. The November 2016 demonetization sucked the remaining life out of the informal sector, a key component of the real estate boom.

As the banking sector stared at mounting bad debts, the government enacted the Insolvency and Bankruptcy Code, 2016 to help lenders explore all options to recover their money within a time frame. The law set a 270 day deadline to find a resolution. JIL found its name in a list of 12 companies the Reserve Bank of India (RBI) had prepared and sent to the banks in June 2017 to invoke bankruptcy proceedings. Gaur was caught napping while he had been trying to work out a deal with IDBI Bank, one of the lenders. But now, the only recourse was the NCLT, Allahabad, where the case would proceed.

Bankruptcy battle

Jaypee’s bankruptcy case was unique as it affected not just the banks, but also around 26,000 homebuyers, as per figures then. All other cases in the RBI’s early list were mostly industries or infrastructure companies. Hence, Jaypee quickly became a matter of public interest.A forensic audit report by T.R. Chadha & Co. Llp for the period between 1 April 2014 to 31 March 2017 found banks ever greening the group’s loans and imposing inexplicably high penalties for pre payment, a strange occurrence given that JIL was in trouble and thousands still awaited the handover of homes.JAL and JIL were both ripped off by banks. Banks have already recovered their principal amount. The litigation has been on for two years now and I believe the case should be settled outside the court.

With nearly a decade of their life gone, even the homebuyers are now divided. Earlier, nine resident groups had been set up just to fight the court battles, but now, some are in favour of a settlement as long as they get the promised apartment. With almost a 60% strength in the ongoing arbitration process, homebuyers have been pushing for a government entity to take over and end the uncertainty. The Noida Development Authority has also given early indication of setting up a “stress fund" to disburse seed money to kick-start stalled projects. While NBCC taking over Jaypee sites as well and using the stress fund to get things started is one option, there are already growing concerns about what these thousands of unfinished homes may do to the balance sheet of the publicly listed company.Irrespective of how exactly the Jaypee saga drags towards a resolution, the case has changed the real estate industry’s outlook forever. If we consider trends in residential real estate over the last two years, demand for ready to move in properties spiked significantly across cities, primarily led by the end users. The Real Estate Regulatory Authority (Rera) is also helping the cause, bringing some trust back into the system. Rera has created a sense of discipline and accountability in developers,

Way forward

But Rera, an entity formed after Jaypee was admitted as a bankruptcy case, offers no hope to the its stranded buyers. They continue to fight their battle at the NCLAT and the Supreme Court.

Awaiting the Supreme Court order, Jaypee cannot be liquidated, which is otherwise a certain outcome in all insolvency cases where no resolution is found. While a mail sent to the company remained unanswered, a top official at the company cited, Gaur’s handing over of the flats in the interim as proof of his commitment. He was not willing to come on record as the matter is sub judice.

The third round of bidding is underway as this story is published, the first two having failed as the banks were unwilling to accept the low quotes offered by the bidders. It is also not clear, how a new buyer will come and complete the projects when Jaypee is best positioned to do it. After all, the new buyer will also want a return.

Everything rests on hope but nobody knows who the enemy is.

Hope you enjoyed reading this edition of our newsletter.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.