I. Homes most unaffordable in four years: RBI (Source - mint)

- Housing affordability in India has worsened over the past four years with Mumbai retaining the top slot

- Bhubaneswar was the most affordable city for home buying with a price-to-income ratio of 54.3 in the March quarter compared to 47.2 in March 2015

Housing affordability in India has worsened over the past four years with Mumbai retaining the top slot as the least affordable city for home buyers, according to Reserve Bank of India (RBI) data released on Thursday.

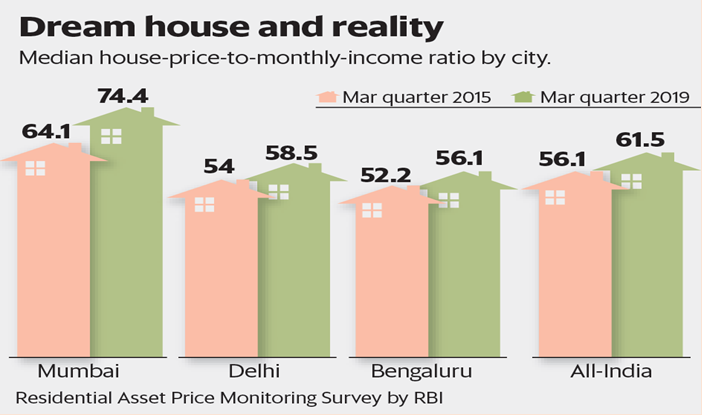

The RBI’s quarterly Residential Asset Price Monitoring Survey showed the house price to income ratio in India increased in the last four years from 56.1 in the 2015 March quarter to 61.5 in the corresponding period of 2019. However, despite being the costliest city in India for home buyers, Mumbai affordability improved to 74.4 in the March quarter from 76.9 in the December quarter.

Bhubaneswar was the most affordable city for home buying with a price to income ratio of 54.3 in the March quarter compared to 47.2 in March 2015.

The National Housing Board was controlled by the RBI before the government took over the housing finance regulator on April 29th. Shifting the regulatory powers to the RBI, will however, take place later in the year as it will require a change to the RBI act.

The Central bank has sought more regulatory powers so that it could be more effective in handling liquidity crunches in the sector, which have hit lending and the overall economy.

The concept of price to income ratio is used by lenders to measure affordability of residential property, essentially as a measure of purchasing power for home buyers.

The key takeaway is that there is a wide gap between home prices in the country and real income. It has only worsened in the last four years.

Therefore the number of years of income required to buy a property has only increased.

Significantly, due to slower growth in residential demand in the last four years, home prices have dropped or remained stagnant in major cities such as Mumbai and Delhi-NCR.

According to a Knight Frank report, there has been a sustained drop in home prices in Mumbai, Pune, Chennai and Kolkata at 3%, 4%, 3% and 2%, respectively, from a year ago period. However, sales volume remained steady at 4% in the first half of 2019.

Conclusion:

The growth in residential prices in the last four years in the top eight cities has been below retail inflation and the gap has progressively increased since the first half of 2016.

As such, sales have been driven mainly by the affordable and middle income housing segment.

Hope you enjoyed reading this edition of our newsletter.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.