I. Will government’s rescue plan get you closer to your dream home? (Source - mint)

- The scheme has widened the scope of funding for stalled projects, which will benefit home buyers

- To avail the benefit, projects need to be net worth positive and registered under the RERA Act

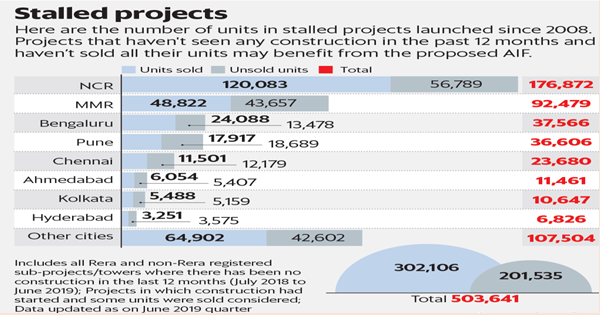

In what seems to be a course correction, more than a month after announcing an unpopular real estate relief package, the government has come up with a funding plan that may give respite to lakhs of home buyers stuck in stalled projects. The government’s proposed alternative investment fund (AIF), worth Rs. 25,000 crore, is expected to provide last-mile funding to stalled projects across the country. According to the government, there are about 1,600 stalled housing projects, consisting of about 458,000 units, across the country.

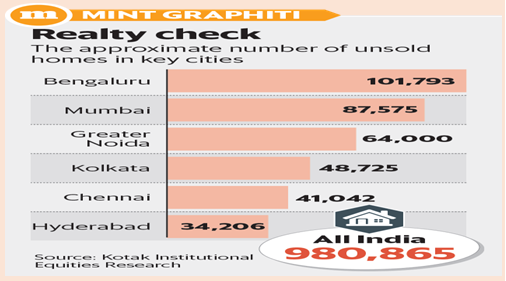

The move may also revive buyer’s confidence in the real estate market. Last quarter’s real estate reports from several consultants revealed a significant drop in housing sales. Experts believe that once the proposed AIF starts disbursing funds, construction in stalled projects will resume, which will boost confidence. Many viable real estate projects were stuck due to the liquidity crunch, lesser sales, customers not buying under construction properties. This step will also lift sentiments and help builders get more and more prospective buyers.

We tell you the projects that are eligible for funding under the government’s AIF, what AIF is, how it works and how it will benefit home buyers of stalled projects.

Eligible projects:

The government’s relief package announced in September promised to benefit only a handful of aggrieved buyers as it was only meant for projects in the affordable and middle income categories that had not been declared as non performing assets (NPAs) and did not have a pending case of insolvency against them in the National Company Law Tribunal (NCLT).

The current announcement removes the caveats, besides bringing in clarity on size and price of units that will get benefited housing unit not exceeding 200 sq. m (carpet area) and city-wise pricing cap of up to Rs. 2 crore, and is, therefore, expected to cover and benefit a large number of stalled projects. This will revive 80% of the stalled projects and will now cover all the projects irrespective of their stage of construction, whether there are cases in the NCLT or are declared as NPAs. Only those already in the liquidation phase are excluded.

This time around, the government has widened the scope of projects that are eligible for funding to include those that have been declared NPA and are undergoing insolvency proceedings under NCLT, but have not gone under liquidation. It is a commendable move by the government as this will widen the scope and ultimately benefit the home buyer.

The projects need to be net worth positive to be able to avail the benefit. Net worth positive projects are those where the value of the receivables plus the value of the unsold inventory is greater than the completion cost and outstanding liabilities of the project. This basically means that only those projects where some amount of sales has happened, and money to be received from the home buyers and the money that the projects will receive after selling the remaining units should be more than the cost of completing as well as the cost of funding the project. For example, take a Rs. 100 crore project, which has received part payment of Rs. 25 crore from home buyers and the cost of completing the project is Rs. 60 crore. Suppose the construction is stalled due to the incapability of the developer to service the debt, and there is further liquidity crunch because the home buyers stop payments due to stalled construction. Further sales in the project also come to a halt. Such a project is likely to benefit from the proposed AIF as the project has a positive networth of Rs. 40 crore (Rs. 100 crore - Rs. 60 crore).

To avail the benefit, projects need to be registered under the Real Estate (Regulation and Development) Act (RERA), 2016. Under the Act, every under construction and upcoming project meeting certain conditions needs to get registered with the Rera of the respective state. According to the ministry of housing and urban affairs, as on 1 November 2019, 46,198 projects are registered underReraacross the country, with Maharashtra having the highest number of registered projects (22,755).

Though the government has not put any criteria on the level of construction that should be completed, preference will be given to projects where the construction can be completed quickly and where a large number of home buyers are expected to benefit. Though all affordable and mid-income projects registered under Rera are eligible for the benefit, provided they fulfil certain conditions, the government has set a value as well as the size limit for the projects.

The size of the houses should not be more than 200 sq. m (approximately 2,000 sq. ft) in terms of carpet area. Also, the cost of a single unit can be up to Rs. 2 crore in the Mumbai Metropolitan Region (MMR), Rs. 1.5 crore in the National Capital Region, Chennai, Kolkata, Hyderabad, Bengaluru and Ahmedabad, and up to Rs. 1 crore in other cities. The price does not include any additional charges for amenities, parking, brokerage and registration and stamp duty charges. However, on a project level, a maximum finance limit of Rs. 400 crore has been placed. There will be caps on project as well as developer levels.

Manner of funding

SBICAP Ventures Ltd may be engaged as the investment manager for the first AIF. After assessing the financial position of various projects, the investment manager would provide funds enabling stalled projects to complete construction and deliver homes to buyers.

However, the fund will not get released to developers in one go. Instead, the allocated fund will get transferred in a special escrow account for that particular project and will be disbursed in accordance with the progress in construction. Construction linked funding will ensure that the project is completed within time.

According to the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012, there are various types of AIFs. The AIFs announced to provide last-mile funding to stalled housing projects will be set up as priority debt funds. Such AIFs do not undertake leverage or borrowing other than to meet day to day operational requirements. Funds such as real estate funds, private equity funds (PE funds) and funds for distressed assets are categorized under this.

According to the finance ministry, a special window is being structured as an AIF to pool investments from other government related and private investors including public financial institutions, sovereign wealth funds, public and private banks, domestic pension and provident funds, global pension funds and other institutional investors and so on. The fund is, therefore, expected not only to support the sector but also generate commercial returns for its investors. The government will come up with a detailed investment policy based on which projects will be selected for financing.

It is definitely a big move and gives a ray of hope to home buyers. However, how many projects will benefit will depend on how many of them are financially viable. The longer the project has been stuck, its cost will go up due to recurring interest in outstanding dues and rise in the cost of construction. Also, it will depend on how much more funding the government can get as Rs. 25,000 crore may not be enough. As per our data, there are over 2,000 stressed projects with potential investment towards leftover construction cost requirements of Rs. 70,000 crore. This fund will be able to provide resolution to 30-40% of stressed projects.Once implementation under the scheme starts, aggrieved home buyers would do well to keep an eye on their stalled projects.

II. Last-mile lender’s interest crucial for revival of stuck home projects (Source - mint)

- Need of the hour is to accord top priority status to last-mile funds as risk taken by them is higher than others.

- About 1,600 projects with about 480,000 dwellings are unfinished for want of funds, leaving all stakeholders in distress.

The Cabinet approval for the creation of a Rs. 25,000 crore alternative investment fund (AIF) to revive scores of stalled housing projects aims to bring back confidence in the beleaguered housing market. However, as the adage goes, the devil is in the detail. The presence of myriad stakeholders in real estate projects and numerous legal, accounting and regulatory compliances pose a challenge to the quick resolution of stranded projects. The first big challenge is to lure investors into the AIF pool, which would be structured as a debt fund. Indeed, the government has set the ball rolling with a Rs. 10,000 crore commitment. It also plans to rope in financial institutions such as State Bank of India and Life Insurance Corp. of India, along with private sector investors.

About 1,600 projects with about 480,000 dwellings are unfinished for want of funds, leaving all stakeholders in distress. But will investors bite the bait? Why will they come as last-mile lenders at a time when the country’s housing market is in a shambles? The need of the hour is to prioritise and accord top priority status to these last-mile funds as the risk taken by them is significantly higher than others. It is important to protect the last-mile lender’s interest. Although the government has indicated the same, it is yet to be clearly defined.

In fact, one can draw a parallel from the roads sector. A May 2015 Icra report explains that when the National Highways Authority of India was ready to fund distressed road assets, the existing lender was asked to furnish a no-objection certificate that NHAI would have the first charge on revenue stream (from annuities and tolls) after the project was completed.

Similarly, the stakes are high for last-mile lender who will step in to complete stuck projects. The cash flows are perpetual in manufacturing companies after the asset is revived. But, in real estate projects, the cash flow is finite and ceases after the asset (property) is transferred to the customer. Hence, it is imperative to set the financial framework of the AIF soon.

The return expectations of private investors would need to be factored into the investment policy, which may result in some narrowing of the eligible project pool.

The report estimates that about Rs. 35,000 - 45,000 crore would be required to fund the completion of the revised quantum of 458,000 eligible dwelling units. Then, there is a legal framework that investors feel are detrimental to their interest. For example, a single home buyer or a vendor in a project can drag the project/developer to court and file for insolvency under the Insolvency & Bankruptcy Code (IBC). Once invoked, the IBC overrides all other contracts, and projects that are re-started can again come to a standstill. Industry experts feel that in the recent past, the angst of home buyers has often led to misuse of legal protection.

That said, expanding the size and scope of the fund has gone down well with the industry. Higher price level of residential units (example: up to Rs. 2 crore in Mumbai and Rs. 1.5 crore in cities such as Pune) that are not eligible for funding shows that the government recognises the need to support stuck projects in the affordable and upper middle class segment.

Further, projects that are under the National Company Law Tribunal (NCLT) or are classified non-performing assets are also eligible, provided their networth is positive. In this context, the onus of evaluating the project will be on the governing committee. Most stuck projects in real estate are special purpose vehicles (SPVs) with thin capital structures, hence it is unlikely that they have positive net worth. Unfortunately, in many cases developers may have even siphoned off funds from the SPVs.

That’s not all. There could be hurdles on closing these projects and evaluating cash flows on account of unsold inventory. Demand risk for the unsold inventory is exacerbated by the macroeconomic weakness. The incremental sale generation from the funded projects will be another key lookout area, especially given the dependence of final recovery of debt obligations on the same.

Be that as it may, the initiative, if implemented soon with stakeholder concerns addressed, can indirectly help kick start the moribund residential sector.

Hope you enjoyed reading this edition of our newsletter.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.