I. Why Foreign Portfolio Investors are swimming against the tide: (Source-The Hindu)

Foreign investors not only need rising stock prices for returns, but also a favourable exchange rate that has often been elusive.

As an Indian investor, you may well believe that trying to make money in the stock market is a frustrating affair. But there is one set of investors who face an even tougher task than you do in getting reasonable returns: Foreign Portfolio Investors (FPIs).

To take home reasonable returns from their India investments, FPIs need not just rising stock prices but also favourable exchange rates. This has not proved easy in recent years.

Dollex trails Sensex

The BSE Dollex 30, an index which translates the Rupee returns on the BSE Sensex basket into dollars based on prevailing exchange rates, is a commonly used gauge of foreign investor’s returns.

The Sensex 30 has beaten the Dollex 30 hands down on trailing returns over the last one, five, 10 and even 15 year period. While the Sensex 30 has delivered a 11.4% gain on a year-to-date basis in 2018 (as of September 14), the Dollex 30 is down by about 1%. Local investors who bought the Sensex basket ten years ago would have a 11.4% annual return to show, but the Dollex 30 has scrounged up just 7%. The lower returns are explained by the fact that while the rupee traded at 47 to a U.S. dollar in September 2008, the going rate today is 71.7.

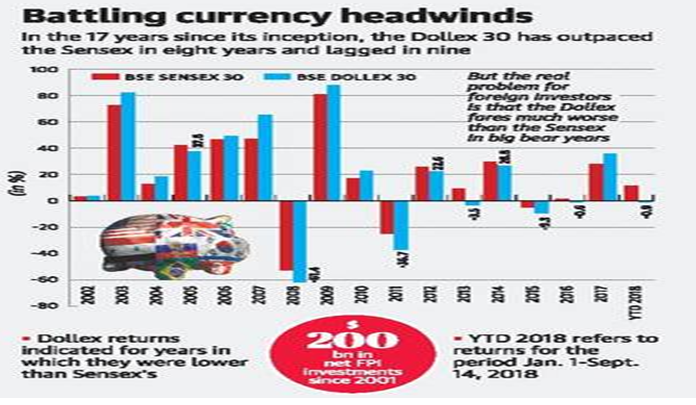

In the 17 years since its inception, the Dollex 30 has outpaced the Sensex in eight years and lagged it in nine. But the real problem for foreign investors is that the Dollex fares much worse than the Sensex in big bear years.

In 2008, hit by the global crisis, the Sensex nosedived by over 52%, but the Dollex plummeted by a steeper 61%. In 2011, the Dollex, with a 37% plunge, lost much more than the Sensex’s 25%. Periods of stock market turbulence in India are often accompanied by a slip-sliding rupee. Perversely though, the Dollex does not always do better than the Sensex in good times. It beat the Sensex in bull years 2017, 2010 and 2009, but lagged it in 2014 and 2012.

Net-net, with rupee weakness magnifying market falls, foreign investors suffer though far bigger swings in their returns than domestic investors.

But with the Dollex hinting at modest as well as highly volatile returns for foreign investors, why are the FPIs such ardent fans of the Indian market? After all, despite the rupee headwinds, FPIs have been net buyers of Indian stocks in 14 of the last 17 years and have poured over $200 billion in net investments since 2001.

How they cope

One explanation could be that many FPIs are good timers of their buys and sells in the Indian market, which helps them benefit from the violent swings in stock prices and the rupee.

For instance, FPIs who bought into the Sensex basket in February 2009 and sold out in December 2010 would have notched up a cool 160% gain in less than two years, with exchange gains adding to returns. Foreign funds who jumped in in August 2013 and bailed out in February 2015 would have pocketed 70%.

It is also likely that long-term FPIs, aware of the exchange rate risks, hedge their India exposures to shield from rupee swings. While this would entail a cost, it would cushion such FPIs from the worst of rupee volatility.

But the most important factor to keep in mind is that FPIs are not one homogenous class of investors who behave like a herd of sheep.

FPI is an umbrella term that refers to a wide gamut of investors using different strategies. It includes individuals and family offices on one hand, but also savvy institutions like sovereign wealth funds, exchange traded funds, pension funds and hedge funds, on the other.

Not all of these investors rely on long-only strategies to make their returns. There’s also considerable churn in the identity of FPIs participating in India from year to year.

All this does not mean that the steadily depreciating rupee does not make a difference to foreign investors. It does. But India’s ability to attract strong FPI flows despite this, suggests that many foreign investors have become adept at swimming against the tide.

II. Only one in every three Indian saves regularly for their retirement: (Source: The Economic Times)

While 76% of working age people in India expect a comfortable retired life, only a third in India are regularly saving for their retirement according to a report HSBC Future of Retirement study.

The lack of saving is likely linked to low knowledge of how much money is needed in retirement, as well as many prioritising their immediate financial situation over planning for their older years.

Inability to anticipate future financial needs is the main roadblock to planning:

While almost two thirds of working people have a financial plan in mind, just under three fifths have sought financial advice to help them for retirement.

45% of people feel it is better to spend money on enjoying life now than saving for retirement.

- 2. 53% save for short term goals rather than longer term plans.

- 3. 56% live on day to day basis financially setting the stage for problems later.

For many, retirement is thankfully no longer a short period tacked on to the end of our life. It can be a long and very fulfilling part of a person's life.

The research for this report was carried out online by Ipsos on behalf of HSBC among 16,000 adults in 16 markets, including Australia, Argentina, Canada, China, Malaysia, Mexico, Singapore, Taiwan, France, Hong Kong, India, Indonesia, Turkey, UAE, UK and USA.

It revealed that only 19 per cent of working age people are saving for future nursing or care home fees. This is despite half (51 per cent) respondents claiming to be concerned about affording residential care when in retirement, it added.

The lack of saving may also be linked to many people not considering their older years as 'retirement' at all, with over two-thirds of working-age people (69 per cent) expecting to continue working to some extent and more than half (54 per cent) hoping to start a business or new venture, it said.

When it comes to knowing the amount of money they will need in retirement, almost two-thirds (65 per cent) of working-age respondents said they were aware of the cost of typical residential home fees.

Also, the report revealed that this is leading a generally positive view of retirement across the globe.

Most working-age people are looking forward to greater freedom away from the nine-to-five (76 per cent), taking up new hobbies and interests (72 per cent) and getting fit (68 per cent), it added.

The steps to consider while planning for retirement moves to make to ensure a comfortable retired life:

- Think differently

- Visualise

- Ask the experts

- Be Meticulous

- Start a conversation

Hope you enjoyed reading this edition.

Disclaimer:

The views of the authors/publishers should not be construed as advice. Investors must make their own investment decisions based on their specific investment objectives and financial positions and using qualified advisors as may be necessary. Opinions expressed in various articles are not necessarily those of Wealthmax Enterprises Management Private Limited(WEMPL) or any of its directors, officers, employees and personnel. Consequently, WEMPL or any of its directors, officers, employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same. Stock picks and mutual fund snapshots are not exhaustive and should not be construed as recommendations.